MT5 Trading Platform’s features, tools, and advantages

The MetaTrader 5 (MT5) platform is a top choice for trading multiple assets. It’s built for the needs of modern traders and brokerage firms. MT5 offers many tools for trading in different markets, like Forex, stocks, futures, and commodities. The MT5 platform isn’t just an update to the popular MetaTrader 4; it’s a major step forward, designed for wider market access and more advanced features. This article will explain what is MT5 trading platform and what is it used for. We’ll look at its main features, useful tools, how to access it on different devices, and its security. We’ll also discuss why MT5 is important for individual traders and brokers. This includes how solutions like Protonix’s integrated WebTrader improve the MT5 experience by giving traders more options.

MT5 is known as an “institutional multi-asset platform” that retail traders can also easily use. This shows a big change in financial technology: powerful trading tools are becoming available to everyone. Retail traders are now looking for and getting advanced analysis and trading abilities that only large financial institutions used to have. MT5 is a key part of this change. So, the platform is more than just a single application; it’s a whole system. It includes features like the “MQL5 Market” for trading robots and indicators, built-in “Signals and Copy Trading” services, and many ways to customise it using MQL5 and Python. These help MT5 create an active community for innovation. This system-wide approach offers great value. It shows that trading platforms now compete not just on basic trading features, but on how much support and community they offer.

What is MT5, and what is it used for?

The MT5 trading platform is a strong, flexible system for trading many types of assets. It allows traders to work with various financial instruments like Forex, stocks, futures, Contracts for Difference (CFDs), and commodities. It does more than just execute trades. It offers a complete environment for detailed price analysis, using both technical and fundamental methods. Traders can also build, test, and use automated trading strategies with Expert Advisors (EAs). Plus, they can create custom technical indicators and scripts to fit their analysis style.

MT5 vs. MT4

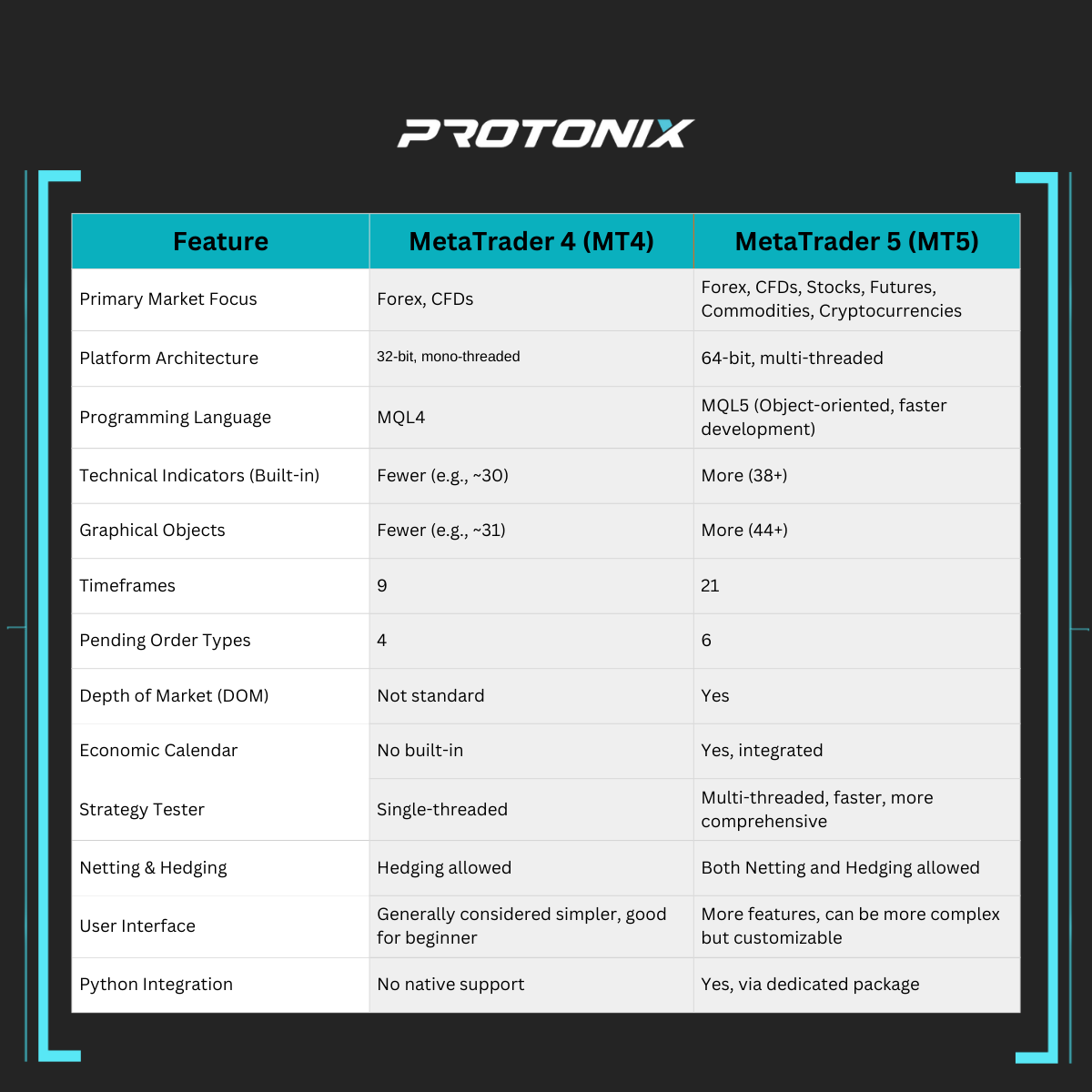

MetaTrader 4 (MT4) was very popular, especially for Forex trading. However, MT5 was created to be a more complex and technologically better platform. Understanding the differences is important for traders and brokers choosing their technology. Let’s see the differences between mt4 and mt5:

Broader Market Access

MT4 focused mainly on Forex. MT5, however, was built to handle many financial instruments. It gives traders access to centralised exchanges for stocks and commodities, as well as decentralised markets like Forex. This ability to trade multiple assets is a key part of its design.

Faster Performance

MT5 is a 64-bit, multi-threaded platform. This means it processes data, executes trades, and backtests automated strategies much faster than MT4, which is a 32-bit, mono-threaded system. This speed is vital for fast-paced strategies and handling lots of market data.

Advanced MQL5 Language

MQL5 (MetaQuotes Language 5) is a more modern, object-oriented programming language, similar to C++. It allows for creating more complex Expert Advisors, custom indicators, and scripts than MQL4, opening up more possibilities for algorithmic trading.

More Analytical Tools

MT5 offers more built-in technical indicators (usually 38+), graphical objects (around 44), and analytical tools than MT4. It also provides 21 timeframes for more detailed chart analysis.

Better Order Management

MT5 supports six types of pending orders, giving more flexibility in planning trades compared to MT4’s four types. It also includes Depth of Market (DOM) functionality, showing market liquidity at different price levels.

Built-in Economic Calendar

MT5 has an economic calendar directly in the platform. This helps traders track important news and events that can affect market volatility, without needing to check other sources.

Market Accessibility

MT5 forex brokers are key to providing access to these varied markets through the MT5 platform. The platform is designed to connect easily with different liquidity providers and exchanges. This allows brokers to offer a wide range of tradable instruments, which attracts traders looking to diversify their investments.

MetaQuotes’ choice to focus on MT5’s ability to handle multiple assets shows an important industry trend. Traders want more ways to diversify and find opportunities, so platforms need to keep up. MT5 and the brokers offering it are ready for this changing demand. Supporting multiple assets is now a standard feature, not just an extra. Also, the improvements to MT5’s speed and backtesting are very important for algorithmic traders, who are a growing group. This shows MT5 is for traders who want to trade more types of assets and use advanced, fast trading methods. The MQL5 language, with its powerful features, helps traders create and use more complex automated strategies. This pushes what’s possible on a retail trading platform.

Essential MT5 features and tools

MetaTrader 5 comes with a wide range of features and tools. These are designed to meet the varied needs of today’s traders, from detailed market analysis to advanced trade execution and management.

Good trading decisions often come from careful market analysis. MT5 provides a rich set of tools for this.

Charting Tools & Timeframes

MT5 has a flexible charting system. Traders can see price movements using different chart types like candlestick, bar, and line charts. A major plus is its 21 timeframes. These range from one-minute charts for quick trades (scalping) to monthly charts for long-term investments. This variety helps traders look at market trends from different angles, matching their trading styles. Users can also change how charts look and save these settings as templates to use on other instruments easily.

Technical Indicators (Built-in & Custom)

The platform includes over 38 built-in technical indicators and more than 44 graphical objects. These cover common types like Trend indicators (e.g., Moving Averages), Oscillators (e.g., RSI, MACD), Volume indicators, and Bill Williams’ indicators. Besides these, MT5 allows traders to create their own custom indicators or use ones made by others with the MQL5 language. This makes MT5 Scripts and Indicators a key part of why the platform is popular, offering a truly personal analysis setup.

MT5 Volume Profile Indicator

The MT5 Volume Profile indicator is a useful tool. It shows trading activity at specific price levels, helping traders find important support and resistance areas. Key parts of the Volume Profile are the Point of Control (POC), the price with the most trading volume, and the Value Area (VA), where about 70% of trading volume happens. Traders use this to judge price stability, find possible breakout areas, and make better entry and exit decisions.

Integrated Economic Calendar

MT5 has a built-in economic calendar. It gives real-time updates on important economic news, central bank announcements, and other events that move markets. This feature lets traders stay informed directly within the platform. It helps with news-based trading or anticipating market volatility without needing other websites or apps.

Automated Trading & Customisation

MT5 is excellent for automating trading strategies and customising the trading experience. Let’s see how:

Expert Advisors (EAs) & MQL5

Expert Advisors are programs that automate trading on MT5. They make trades based on set algorithms without needing manual action. EAs are made using MQL5 (MetaQuotes Language 5), a high-level, object-oriented language similar to C++. MT5 includes the MQL5 IDE (MetaEditor) for writing and fixing code, an MQL5 Wizard for easier EA creation, and a multi-threaded Strategy Tester for thorough backtesting and optimising EAs with past data. The MQL5 Community and an integrated Marketplace also offer many free and paid EAs and MT5 Scripts, and Indicators.

Leveraging MT5 with Python

A key improvement is the MT5 Python integration, made possible by a special Python package. This lets traders and developers connect Python scripts directly to the MT5 terminal. The main advantage is using Python’s many libraries for complex data analysis, machine learning, statistical modelling, and advanced visuals. These can do more than MQL5 alone. For example, it can be used to develop complex trading algorithms, create custom analysis dashboards, and add external data for better strategy development.

Trade Execution & Management

The capacity to manage positions and execute transactions with precision and speed is essential, from the initial identification of a trading opportunity to its full potential.

Order Types & Depth of Market (DOM)

MT5 provides many order types. These include market execution orders and six types of pending orders: Buy Stop, Sell Stop, Buy Limit, Sell Limit, Buy Stop Limit, and Sell Stop Limit. This range gives traders precise control over their entry and exit plans. The platform also has Depth of Market (DOM) functionality. This shows the current volume of buy and sell orders at different prices, giving insight into market liquidity and order flow.

MT5 Terminal Navigation

The MT5 terminal interface is organised into key windows for an efficient workflow:

- Market Watch: Shows real-time quotes, spreads, and daily high/low prices for chosen instruments.

- Navigator: This tool provides quick access to trading accounts and lists of available indicators, Expert Advisors, and scripts.

- Toolbox (or Terminal in older versions): A window with multiple functions. It shows active trades, account balance and history, news, alerts, logs, and market exposure.

MT5 Position Size and Lot Size Calculators

Good risk management depends on correct position sizing. MT5 itself doesn’t have a universal built-in calculator. However, many MT5 forex brokers offer, or traders use, third-party EAs or separate tools as an MT5 position size calculator or MT5 lot size calculator. These tools help traders find the right trade volume. They use factors like account money, desired risk per trade, stop-loss distance, and the instrument’s contract size and currency. They often calculate risk-reward ratios and margin needs.

MT5 Trade Manager

MT5 trade manager tools, usually EAs, offer advanced ways to manage trades. They can include one-click trading, automatic setting of stop-loss and take-profit, trailing stops, break-even functions, partial closing of positions, and managing many trades at once. These tools make trading smoother, help maintain discipline, and improve risk management.

Social & Copy Trading

MT5 includes features for the growing interest in social and copy trading.

MT5 Copy Trading Systems & Signals – MT5 copy trading lets traders, especially those with less experience or time, automatically copy the trades of experienced professionals (signal providers or strategy leaders). MT5 has a built-in “Signals” service. It’s accessible through the platform and the MQL5 community website. Traders can subscribe to signals from different providers there. This offers benefits like access to expert knowledge, learning chances, and portfolio diversification for followers. Providers can also earn extra income. Various third-party software also exists for copy trading on MT5, sometimes with advanced features like cross-server use and better management tools for brokers.

The wide range of analytical tools, along with strong customisation through MQL5 and Python, shows MT5 is for traders of all skill levels. Beginners can use the simple aspects and basic tools. Advanced users can use the platform’s full power for complex strategy development and automation. This flexibility helps traders grow, and as they become more skilled, they demand even more advanced features. Tools like EAs, position size calculators, and trade managers show the platform’s commitment to disciplined risk management. By automating some decisions and calculations, these tools reduce emotional trading and ensure trades match set risk levels. This leads to more systematic and risk-aware trading. Copy trading features offer easy ways to join potentially profitable strategies, but they also need care. Copying expert trades is convenient, but it’s important to check the signal provider’s performance and risk management. Information about these features should stress making informed choices, not just blindly following signals.

MT5 Accessibility

MetaTrader 5 is designed for access everywhere. This ensures traders can reach the markets and manage their accounts from many devices and operating systems, a key reason for its popularity.

Desktop Platforms

The desktop versions of MT5 offer the most complete set of features and analytical tools.

- MT5 Download for PC (Windows): This is the standard and most common version. The MT5 download for pc is usually an .exe file, making installation on Windows easy. It provides all MT5 functions, including advanced charting, automated trading with Expert Advisors, and many customization options. System needs are usually low, so it works on most modern PCs.

- MT5 Download for Mac (McIntosh): Since more people use Apple computers, MetaQuotes and various brokers offer special MT5 download for mac versions, often as. dmg or.pkg files. This lets MT5 McIntosh users run the platform natively, with similar features to the Windows version. Installation is usually simple, but some older macOS versions might need extra steps for compatibility.

- MT5 for Linux: MT5 doesn’t officially support Linux natively. However, it’s possible to run MT5 for Linux using tools like Wine. Programs like PlayOnLinux can make installation and management easier. Core trading functions generally work well this way, but users might sometimes find small bugs or performance issues due to the emulation.

Mobile Trading

Trading on the go is vital for many modern traders, and MT5 offers strong mobile options.

The MT5 App (iOS and Android)

Special MT5 app versions are available for both mt5 ios (iPhone and iPad) and mt5 for android devices. These mobile apps offer a rich trading experience. Users can check their account status, view trade history, and make trades with one click. They also offer news alerts, a full set of trade orders, access to many trading instruments, interactive charts with multiple types and over 9 timeframes, and a choice of over 30 built-in technical indicators and 24 analytical objects. This ensures traders can stay connected to markets and manage positions from almost anywhere.

Web-Based Access

Web solutions are available for traders who don’t want to install software or need access from different computers.

MT5 WebTrader

The MT5 webtrader lets users trade from any modern web browser without needing to download or install software. It gives access to the main trading functions, including placing orders, charting tools, technical indicators, and account management. While its interface might be simpler than the desktop version, it’s a handy way to access markets from any device with internet and a compatible browser.

Our WebTrader with MT5 Integration

At Protonix, we understand that traders need flexibility. That’s why our WebTrader is integrated with MT5 so traders have options. This integration means traders aren’t limited to one interface. They can choose the access method that best suits their current needs, all while connected to the strong MT5 backend. The Protonix WebTrader is designed to be a great alternative or addition to standard MT5 applications.

Where to Download MT5

Traders wondering where to download MT5 can find it at several official places.

- The official MetaQuotes Software Corp. website.

- Directly from the websites of MT5 forex brokers

- The Apple App Store for the MT5 iOS application.

- The Google Play Store for the MT5 for Android application.

MT5’s wide availability across many platforms and devices shows a big change in what traders expect: they now demand constant connection and the ability to manage trades from anywhere. For brokers like Protonix, offering a complete, multi-channel experience, including a capable WebTrader smoothly integrated with the MT5 backend, is key to attracting and keeping a varied clientele. WebTraders, especially when integrated with a powerful system like MT5 , are a strategic plus. They can be a simple starting point for new traders who might find the full desktop app too complex, while also being a handy, quick-access tool for experienced traders. It offers a flexible system that suits different user preferences and trading situations. Even the “unofficial” but working support for Linux through solutions like Wine shows the platform’s reach and its user community’s dedication to making it available on their preferred systems.

Is MT5 Trading Safe?

The question, “Is MT5 trading safe?”, is very important for any trader. MetaTrader 5 has several security layers. When combined with the practices of good brokers and user care, it offers a secure trading environment.

MT5 Security Design

- Data Encryption: A key part of MT5’s security is encrypting data sent between the client terminal, the broker’s servers, and other platform parts. This usually involves strong encryption, like 128-bit keys, to protect private information like logins, trade details, and account data during transfer.

- Server Security: The overall trading environment’s safety greatly depends on the broker’s server strength and MetaQuotes’ secure platform design. This includes protection against cyber threats, unauthorised access, and denial-of-service attacks. Servers are often monitored constantly to quickly find and deal with any harmful activity or system problems. For brokerages, having their own MT5 server can give more control over security and platform reliability.

- Authentication: Access to an MT5 account is protected by secure login steps. These require a unique username (account number), password, and choosing the correct trading server. This helps prevent unauthorised account access. MetaQuotes designs the platform to resist common threats, though the exact technical details of its core security are private.

Choosing Reputable MT5 Forex Brokers

While MT5 itself provides a secure technology base, the overall safety of trading also depends a lot on the chosen MT5 forex brokers. It’s vital to pick brokers regulated by known financial authorities. Regulation often requires strict security standards, keeping client money separate from the firm’s money, and fair trading practices. Good brokers invest in their security and clearly explain their safety measures.

Setting Up and Managing Your MT5 Account Securely

User care is the third part of trading security. Traders should follow best practices for online safety. This includes creating strong, unique passwords for trading accounts, watching out for phishing and other social engineering tricks, and keeping trading devices (computers, smartphones) secure. When opening an MT5 account, demo or live, users usually need to give personal information for verification. This is to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

The security of MT5 trading is a shared job between MetaQuotes (the developer), the brokerage, and the trader. MT5 offers strong technology with data encryption and secure login. However, the broker’s regulation and security measures, along with the trader’s own safety habits, are just as important. The wide use and long history of MetaTrader platforms also build general trust in their security. It’s also important to know that “safety” in trading means more than just cybersecurity. It includes platform reliability and uptime. Financial losses can happen if a platform is unstable or slow, especially in volatile markets. MT5’s 64-bit, multi-threaded design and the quality of a broker’s server aim to ensure it works reliably, which is a key part of a safe trading experience.

MT5 for Brokerage Owners

MetaTrader 5 offers big advantages for brokerage owners. It provides a strong platform to attract different types of clients, simplify operations, manage risk, and grow the business. Its many features and flexible design make it a key tool for modern brokerage services.

MT5’s ability to handle multiple assets lets brokers offer trading in Forex, stocks, commodities, indices, and cryptocurrencies. This appeals to a wide range of traders with different interests and strategies. The platform’s advanced analytical tools, support for automated trading with Expert Advisors (EAs) and Python, and easy mobile and web access make it attractive to both new and experienced traders.

Another significant advantage for brokers is the powerful MT5 API (Application Programming Interface). This interface is the key to creating a connected business ecosystem. It allows brokerages to integrate the MT5 trading server with their other essential systems, such as their CRM, client area (trader’s room), and payment solutions. Using the MT5 API, processes like new account creation, deposit and withdrawal tracking, and client communication can be automated.

Back-Office & Efficient Operations

The MT5 manager terminal gives brokers tools to manage client accounts, watch trading activity, handle financial transactions (like balance and credit changes), and create reports. The platform supports different ways of executing trades and allows both hedging and netting of positions. This gives brokers flexibility in managing orders and client accounts. Importantly, MT5 is designed for integration. Using APIs, brokers can connect the platform to their Customer Relationship Management (CRM) systems, payment systems, and other third-party tools. This automates tasks and improves client service.

Reporting and Compliance

MT5 has strong built-in reporting features. These let brokers track trading volumes, client activities, and overall performance. This data is very useful for internal analysis and decisions. Brokers can also use this data, often by integrating with special regulatory technology (RegTech) solutions, to meet their reporting duties under rules like EMIR or MiFIR. Such integrations make reporting easier, reduce errors, and help maintain transparency.

Risk Management Tools for Brokers

The platform offers several tools to help brokers manage financial risk. These include setting and changing leverage for different clients or instruments, watching client margin levels in real-time to prevent too much exposure, and tools for managing liquidity connections. MT5’s stable and high-performance design also helps reduce operational risk by ensuring reliable trade execution and platform uptime.

MT5 White Label Solutions

For new or smaller brokerages, an MT5 White Label solution is a great way to enter the market. This model lets a firm offer the MT5 platform under its brand without the large initial cost of buying a full MetaTrader server license from MetaQuotes. Instead, the broker “rents” a branded and customised version of the platform from a technology provider who already has a full license.

Advantages include much lower startup costs, quicker market entry, handing off complex technical tasks like server maintenance and IT support, and access to existing liquidity connections.

Things to consider include some reliance on the White Label provider for service quality and technical support, and possibly less customisation freedom than owning a full server license.

API Integration for Custom Solutions & Liquidity

MT5’s design allows integration through various Application Programming Interfaces (APIs). The MetaTrader Manager API lets brokers add core MT5 functions (like account creation, balance changes, trade data access) directly into their own systems, such as CRMs or client portals. This creates a smooth user experience. The Financial Information Exchange (FIX) API is often used to connect MT5 servers to liquidity providers. This allows brokers to get liquidity from multiple sources or even act as liquidity providers themselves. Also, Data PUSH services can sync MT5 trading data with external databases in real-time. This helps with custom analytics, advanced reporting, and business intelligence.

Flexible solutions like White Label MT5 and full API sets show that the platform is designed to support brokerages of different sizes and technical abilities. Startups can use White Label solutions for a quick and cheap market entry. Larger, established firms can use APIs for deep system integration and creating unique services. This adaptability helps create a lively and competitive brokerage market. The growing use of APIs to connect trading platforms with CRMs, payment systems, liquidity sources, and compliance tools shows a major shift in brokerage operations. Modern brokerages are like interconnected systems, and APIs are key to this integration, with MT5 often at the centre. While White Label solutions are a good way to enter the market, there’s a trade-off between cost and control. As a brokerage grows, it might want more control over its platform, branding, and technology. This, along with the benefits of a dedicated server, might lead it to buy a full MT5 license or find advanced White Label providers offering more customisation and control.

Exploring Alternatives: When to Consider Other Platforms

While MetaTrader 5 is a leading and very flexible trading platform, no single solution is perfect for every trader’s unique preference or every brokerage’s specific need. Knowing when an alternative to MT5 might be worth considering gives a clearer view of the trading platform options.

Situations where alternatives could be looked at include:

- Desire for Extreme Simplicity: Some traders, especially complete beginners, might find MT5’s many features overwhelming at first. Although MT5’s interface can be customised and simplified, and options like the Protonix WebTrader offer easier access, those wanting a more basic, stripped-down trading experience might look at platforms known for being beginner-friendly, like MetaTrader 4 in its classic form.

- Very Specific Niche Needs: For traders focusing on highly specialised areas (like complex options strategies) or using unique trading styles, platforms built just for that niche might offer advantages not found in MT5’s broader, though powerful, multi-asset design.

- Proprietary Broker Platforms: Some large, well-known brokerage firms create their own in-house trading platforms. These are often deeply connected with the broker’s specific services, liquidity, and research, potentially offering a unique system for their clients. Examples include platforms like cTrader or TradingView, which brokers sometimes offer alongside or instead of MT5.

Despite these points, it’s important to remember the strong reasons that make MT5 and Protonix’s integrated offering a top choice for most brokers. Its strong multi-asset features, advanced analytical and charting tools, sophisticated automated trading support via MQL5 and Python, wide use by brokers globally, and a large, active user community are major benefits.

Also, the Protonix WebTrader, smoothly integrated with the MT5 backend, directly addresses some common reasons for looking for alternatives. It particularly meets the desire for easy access and a user-friendly interface, without losing the underlying power and reliability of the MT5 engine. This gives traders valuable options, letting them choose the interface that best suits their current needs or preferences.

Discussions about alternatives often highlight how MetaTrader platforms are seen as the standard. The need to compare new or niche platforms against MT4/MT5 shows their strong market presence and the high standards they’ve set. By focusing on delivering and improving the MT5 experience, especially with flexible access like an integrated WebTrader, Protonix aligns with a platform that has significant market trust and user recognition. The ongoing debate between simplicity for beginners and full capability for advanced users is well handled by offerings like the Protonix WebTrader. It acts as a bridge, providing an easy and intuitive way to enter the markets, backed by the full power and features of MT5, ready as the trader’s needs grow. This means “alternatives” are not just about completely different platforms but also about varied, user-focused ways to access a powerful, established core.

MT5 with Protonix

MetaTrader 5 is firmly established as a complete and powerful multi-asset trading platform. It gives traders and brokers worldwide advanced analytical tools, strong automation features, and wide accessibility. Its design suits a broad range of market users, offering the depth needed by experienced professionals while being easy enough for those new to trading. For individual traders, MT5 provides the tools to make smart decisions, develop and test different strategies, and trade in global markets across many asset classes. For brokerage owners, it offers a competitive, scalable, and highly integrable platform solution that can attract a diverse client base and support efficient operations.

However, the true power of MT5 can be further unlocked with innovative, user-focused solutions. Protonix enhances the MT5 experience by understanding the modern trader’s need for flexibility and choice. This integration ensures users aren’t stuck with a single access method. They can easily switch between the full-featured MT5 desktop application, the handy MT5 mobile apps, or the very accessible Protonix WebTrader, based on their needs, location, or even current preference. All these access points connect to the same powerful and reliable MT5 backend, ensuring consistency in account information, positions, and trading history.

The Protonix WebTrader, as described, offers instant browser access without downloads, full MT5 account synchronisation, an intuitive interface, comprehensive charting tools, and efficient order management, all in a secure environment. This is a great option for traders who value ease of access or a simpler interface, without giving up the core analytical and trading power of the MT5 engine.

In the end, MetaTrader 5, especially when boosted by forward-thinking solutions like Protonix’s integrated WebTrader, gives both traders and brokers the tools and flexibility needed. The future of trading platforms seems to be about integrated flexibility, where users expect smooth transitions and consistent experiences across multiple devices and interfaces.