A-Book Broker vs. B-Book Broker

Summary: Confused by A-Book and B-Book forex brokers? Don't be! These models determine how trades are executed, impacting everything from transparency to speed. This article breaks down each model, exploring its advantages and potential drawbacks. Discover which execution style best suits your brokerage and empowers your clients, whether they value crystal-clear execution or razor-thin spreads.

In our industry, there’s a maze of abbreviations and specialized vocabulary. Have you ever stumbled upon the terms “A-Book Broker” and “B-Book Broker” while researching forex brokers? Or maybe someone mentioned it once and you didn’t know what it was? Or perhaps it was previously discussed and you were unaware of its nature? Maybe you run a brokerage and are having trouble deciding which model to use. Whichever viewpoint you hold, the purpose of this piece is to clarify these two important execution models.

Now let’s explore the main ideas: What are the A-Book and B-Book models specifically? What effect do they have on your business, and how do they operate?

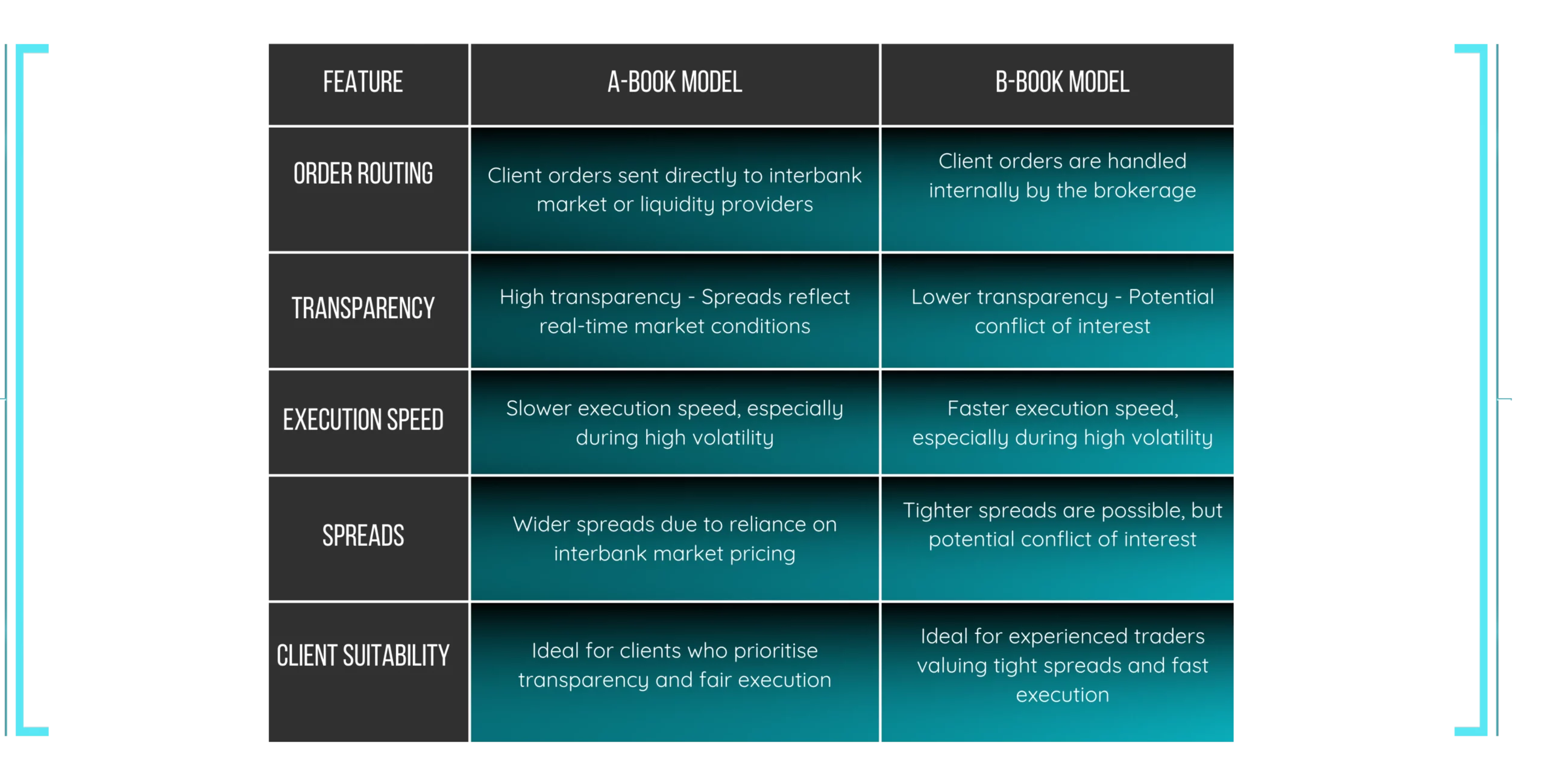

Forex might appear simple for forex traders– a click of a button, and voila, a trade is placed. However, the real magic unfolds in the background. To complete the transaction, there has to be a corresponding sell order for each buy order. Here’s where the A Book and B Book models come into play, serving as various routes to market delivery of customer orders. Let’s examine these models in more detail and weigh their benefits and cons.

What is an A-Book Broker Model?

Think of your brokerage as a quick courier service for forex trades. In the A-book model, your clients’ orders are like urgent packages. You grab them and zip them straight to the interbank market, where major banks trade currencies. Your clients’ orders get matched with other traders looking for the opposite deal there.

A-Book’s transparency is one of its greatest features. The spread, or the difference between the buy and sell prices, is a reflection of the current state of the market; your brokerage is not involved in the deal. The movement of the market determines whether your clients make money or lose money. Establishing trust through this strategy may be a powerful selling point for clients who value transparency and fair execution.

What is a B-Book Broker Model?

See a B-Book broker as being somewhat more “hands-on.” Rather than placing orders on the interbank market, they take on the role of market maker. It means that they enter into transactions on the other side of your clients. Therefore, the brokerage is effectively selling the same currency pair to the customer if they purchase it.

There may be issues with this model. There can be a conflict of interest since your brokerage would lose out if your clients succeed, and vice versa. But notably in volatile markets, B-book brokers frequently provide tighter spreads and maybe speedier execution. Some traders may find these aspects appealing, especially those who use high-frequency trading techniques.

What is a Hybrid Broker Model?

A hybrid model combines both A-Book and B-Book techniques, as the name suggests. Certain brokerages can use a combination based on the amount of the deal or the state of the market. For instance, bigger deals may be forwarded to the interbank market for better pricing, while smaller trades may be handled internally for quicker execution. This strategy may provide an efficiency and transparency balance.

Choosing the Right Model for Your Brokerage

There’s no one-size-fits-all answer. There isn’t a universal solution. A-Book can have an important advantage in attracting clients who value fair execution since it provides transparency and eliminates conflicts of interest. With narrower spreads and quicker execution, B-Book may draw customers, especially those using high-volume trading methods.

The secret is to pick a model that complements both your target market and your overall company plan. Think about the kinds of clients you wish to draw in. Do you wish to serve newcomers who value an open and instructive atmosphere? Or are you going for seasoned traders who like quick execution and narrow spreads?

Regardless of your clients’ trading preferences, you may position your forex brokerage as a reliable partner by carefully weighing your choices and customizing your strategy.