Automatic Identity Verification in KYC

Summary: Imagine clients who are enthusiastic to trade rather than discouraged by bureaucracy. Automatic KYC makes it a reality. This revolutionary technology automates crucial procedures, reducing onboarding time and increasing client happiness. Learn how to unleash your staff, delight customers, and unlock growth.

Look, we all know the struggle. Clients get excited about trading, sign up, and then… hit the ugly KYC wall. Forms, documents, verification – it’s enough to send even the most enthusiastic trader leaving. But what if there was a way to simplify the entire process and get your clients trading faster? No more questions like “Can I do KYC online”!

Introducing Automatic KYC, your new hidden weapon for easy onboarding and satisfied customers. This tool uses advanced technology to automate an essential phase in the KYC process, saving you time and money while increasing customer satisfaction.

When it sounds too good to be true, you’d want to dive deeper. So let’s!

Highlighting the advantages

Reduce onboarding time

Consider this scenario: a client registers, his information is automatically validated against trusted databases, and his account is authorized immediately. No more chasing paperwork or manual checks – just smooth onboarding that puts your clients trading in minutes.

Automatic KYC handles tasks like:

- Identity verification: Check IDs against government databases for rapid approval.

- Address verification: Use trustworthy sources to rapidly confirm addresses.

- PEP and Sanctions Checks: Automatically verify against global watchlists.

Using the automatic KYC, you allow your staff to focus on high-value work while providing a better experience for your clients.

Say Goodbye to Frustrated Clients (and Hello to More Conversions!)

Let’s face it: the typical KYC procedure may be quite a turnoff for potential clients. Long wait times, confusing documents, and a lack of clarity all contribute to frustration and account cancellation.

Automatic KYC changes the game by:

- Lower wait times: Clients get accepted right away, keeping them engaged and enthusiastic.

- A simplified process: No more complicated forms, simply an easy, intuitive experience.

- Transparency for your clients: They see real-time information on the progress of their applications.

The result? Happier customers, increased conversion rates, and a thriving business.

Increase Profits with Automatic KYC

Let’s discuss money. Every minute your staff spends on manual KYC drains your resources. Time spent validating paperwork, pursuing information, and maintaining compliance does not contribute to the growth of your organization.

Automatic KYC saves you money by:

- Reduced Labor Costs: Free up your team to focus on high-value tasks like marketing and client support.

- Reduced Errors: Automated checks mean fewer manual errors, reducing compliance fines and rework costs.

- Improved Scalability: Handle more clients seamlessly without needing to expand your KYC team.

The result? Automatic KYC is a one-time investment that pays off in the long run by improving your operations and processes.

How it works

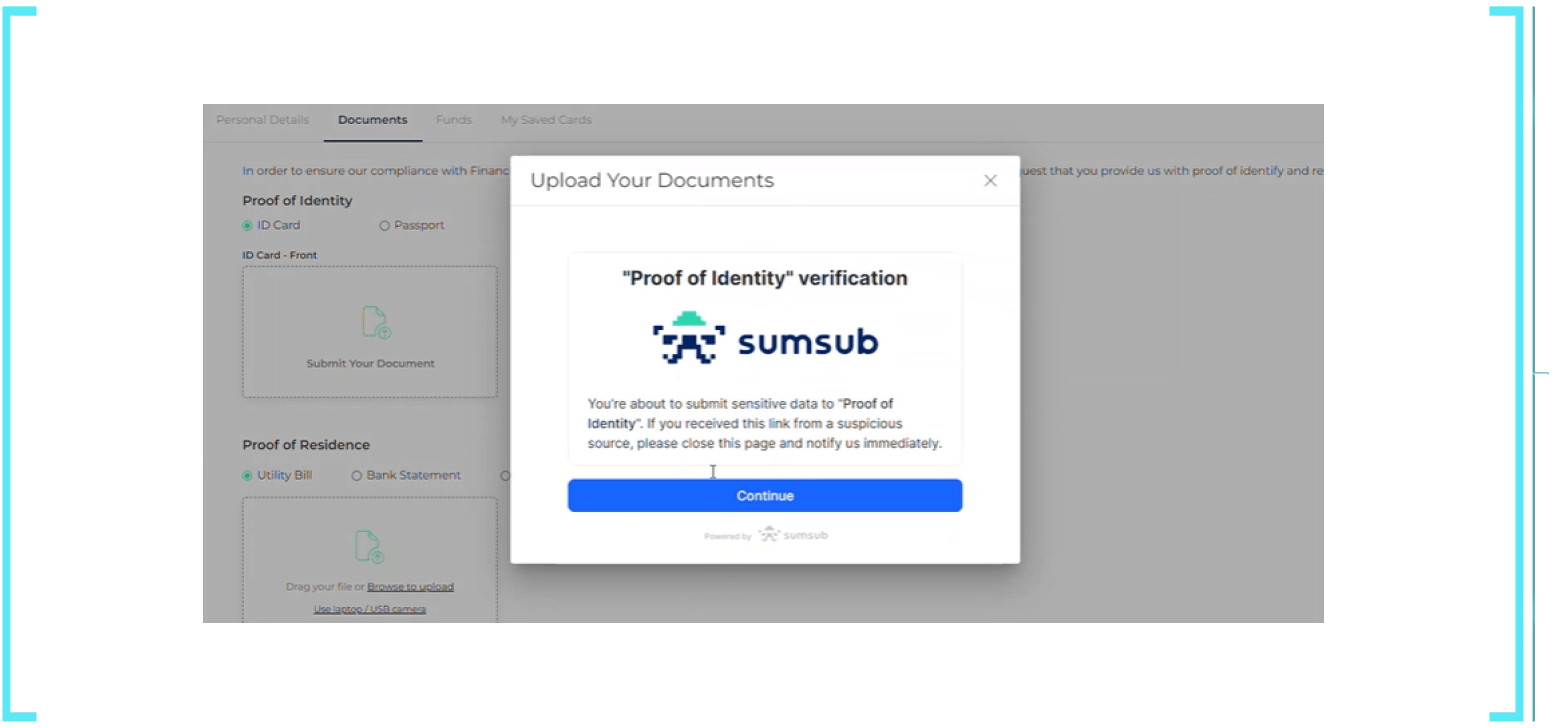

- Log in: Clients need to go to the “Documents” tab in their account.

- Upload Documents: Clicking “Upload Documents” a Sumsub pop-up will appear.

- Select & Upload: They’ll have to pick their country of residence and document type (ID, passport, etc.).

- Snap & Capture: Upload their document (from their PC or phone) and capture the back.

- Selfie Time: They have to take a quick selfie photo for verification.

- Relax & Wait: Their data will be processed in a flash.

- Approval & Go!: Once approved, their documents will be displayed in their “Documents” tab.

- That’s it! No need to chase forms, wait, or send emails – Automatic KYC handles everything efficiently.

Automatic KYC isn’t just a feature, it’s a game-changer for your business.