How to Navigate the Brokerage World and Avoid Regulatory Trouble

Summary: Regulatory compliance is a critical part of doing business in our industry. In this article, we’re discussing the importance of regulatory compliance and the challenges that brokerages face in complying with regulations.

Staying up-to-date with industry regulations is crucial. You have to really get a good grasp of them and make sure you follow them correctly. Why, you ask? Well, for starters, staying compliant can help you avoid any legal trouble that could potentially sink your business faster than the Titanic.

Regulatory compliance is all about following the rules set forth by governing bodies to ensure fair practices and protect both investors and brokers. By staying compliant, you not only build trust with your clients but also safeguard your reputation.

So join us as we explore the ins and outs of regulatory compliance in the brokerage world. We’ll uncover tips and tricks to help you navigate this complex landscape while keeping your sanity intact. Let’s get started!

Key Regulatory Challenges Faced by Brokerages and How to Overcome Them

Navigating through the regulatory landscape can be a real challenge for brokerages. With ever-evolving regulations and compliance requirements, it’s important to stay ahead of the game and ensure that your business is on the right side of the law.

One of the key regulatory challenges faced by brokerages is staying up-to-date with changing regulations. It can be overwhelming to keep track of all the updates and amendments, but it’s crucial to stay informed in order to avoid any regulatory risks.

Another challenge is meeting broker licensing requirements. Each jurisdiction may have different licensing requirements, making it necessary for brokerages to carefully review and fulfil all the necessary criteria. This process can be time-consuming and complex, but it’s essential for maintaining compliance.

To overcome these challenges, brokerages can adopt a proactive approach. This includes regularly monitoring regulatory changes, seeking legal advice when needed, and implementing robust compliance systems. Investing in technology solutions that automate compliance processes can also help streamline operations and reduce potential risks.

Onboarding and Regulatory Compliance

Effectively managing onboarding and regulatory compliance requires robust technology solutions. You’ll need tools that can automate compliance processes, helping you stay up-to-date with the latest regulations, and facilitate the development of a comprehensive compliance program.

Customizable Approach: Every regulator has its specific guidelines, and you’ll need a flexible onboarding system that caters to these variations. For instance, for CySEC-regulated brokerages, your platform needs to facilitate the collection of necessary KYC documents after the first deposit, while ISIC-regulated entities need the KYC verification before the initial deposit.

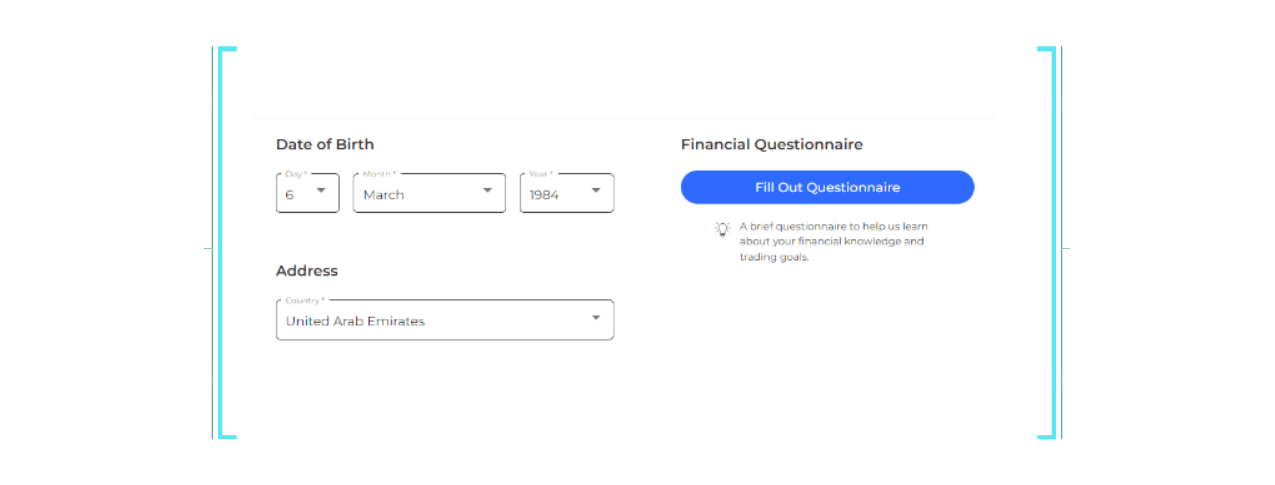

User-Friendly Process: Use a platform that makes compliance a breeze for both you and your clients. After a simple email and phone registration, traders create their accounts. Age verification ensures regulatory alignment, preventing underage trading. Clients can conveniently select their preferred currency from available options based on their chosen brand.

Adaptable Questionnaires: A crucial aspect of compliance is the trading questionnaire, which varies in complexity across different regulators. Make sure that the technology you use gives you the flexibility to configure the questionnaire logic according to regulatory requirements. This ensures that your brokerage adheres to even the most stringent demands.

Questionnaire Score: Empowering Informed Trading

The trading questionnaire isn’t just a formality, but a tool for empowering traders with knowledge. After completing the questionnaire, our platform provides traders with immediate feedback through a pop-up message. This transparent approach ensures traders grasp their strengths and areas for improvement before embarking on live trading.

Complex Logic for Tough Regulators: Some regulators demand thorough testing of a trader’s understanding, and our platform can adapt to these requirements. If a trader’s answers raise concerns, our system may prompt further actions, such as recommending additional training or temporarily limiting trading until further measures are taken.

Balanced Flexibility: We understand the risks involved in trading, and our platform provides a balanced approach. Traders who receive warnings about their answers can choose to either continue trading or improve their knowledge before attempting live trading. This approach allows traders to make informed decisions about their trading journey.

Enhanced Email Notifications: A Trustworthy Path to Compliance

Regulatory Transparency: Compliance isn’t just about adhering to rules; it’s about keeping traders well-informed. Traders receive essential email notifications mandated by regulators. Whether it’s a “Deposit Declined” notification or other critical updates, our platform keeps traders updated on every significant account activity.

Empowering Traders: We enable traders to stay involved and actively manage their trading activity by giving them these critical updates. Our timely emails create a sense of trust and reliability, promoting a transparent trading relationship.

Brokerage and Client Safety: Both the brokerage and the client benefit from regulatory compliance. In the event of a disagreement or misunderstanding, having a written record of email notifications might act as a safeguard for both parties. This improves accountability and reduces the likelihood of disagreements.

Proactive Compliance Tip: Safeguarding Trader Recommendations

Hands-Off Trading Advice: Maintaining a clear division between agents and traders is a good method for preserving regulatory compliance. We strongly believe that brokers should emphasize extensive training to ensure that their call center representatives never give trading advise or suggestions to clients.

Recording Accountability: As a brand manager utilizing our CRM, you hold a powerful tool to maintain compliance effortlessly. With access to agent-client recordings, you have a direct path to monitor interactions. This feature proves invaluable, especially during regulatory audits. In the event of an audit, you can easily review conversations, the adherence to guidelines and regulations.

A Shield of Assurance: Our CRM’s recording feature acts as your armor of assurance, safeguarding both your brokerage’s reputation and your client’s interests. By ensuring trading recommendations are not part of the agent-client discourse, you elevate trust, transparency, and regulatory adherence.

Regulatory compliance goes beyond checkboxes – it’s about creating a trading environment where informed decisions, transparency, and safety converge.